7 Proven Ways to Measure Customer Satisfaction in 2025

Discover 7 effective ways to measure customer satisfaction. Our guide covers NPS, CSAT, CES, and more to help you gather actionable feedback and boost loyalty.

Posted by

In today's competitive market, simply offering a great product isn't enough. Lasting success is built on a deep, data-driven understanding of customer happiness. But how do you move beyond guesswork and start gathering concrete data on what your clients truly think? Measuring customer satisfaction isn't just about collecting ratings; it's about unlocking insights that directly influence loyalty, reduce customer churn, and fuel sustainable growth for your business.

This guide explores seven powerful ways to measure customer satisfaction, providing actionable steps to turn raw feedback into a strategic asset. We'll examine a range of techniques, from established metrics like Net Promoter Score to qualitative methods like customer interviews and social media listening. You will learn not just what to measure but how to implement these systems effectively.

Furthermore, we will connect these methods to platforms like EndorseFlow, demonstrating how to seamlessly collect testimonials and leverage that positive feedback across your social channels. This approach turns satisfied customers into your most powerful advocates. By the end of this article, you'll have a clear roadmap for not only measuring but also actively improving the customer experience at every touchpoint.

1. Net Promoter Score (NPS)

Net Promoter Score (NPS) stands as one of the most direct ways to measure customer satisfaction by focusing on a single, crucial aspect: customer loyalty. Popularized by Fred Reichheld of Bain & Company, it hinges on the straightforward question, "On a scale of 0 to 10, how likely are you to recommend our company/product/service to a friend or colleague?" This simplicity allows for quick deployment and easy tracking over time.

Customers are then categorized based on their numerical response:

- Promoters (9-10): These are your most loyal and enthusiastic customers. They are valuable brand advocates who actively contribute to positive word-of-mouth.

- Passives (7-8): This group is satisfied but lacks real enthusiasm. They are vulnerable to competitive offers and are unlikely to actively promote your brand.

- Detractors (0-6): These are unhappy customers who can actively damage your brand's reputation through negative feedback.

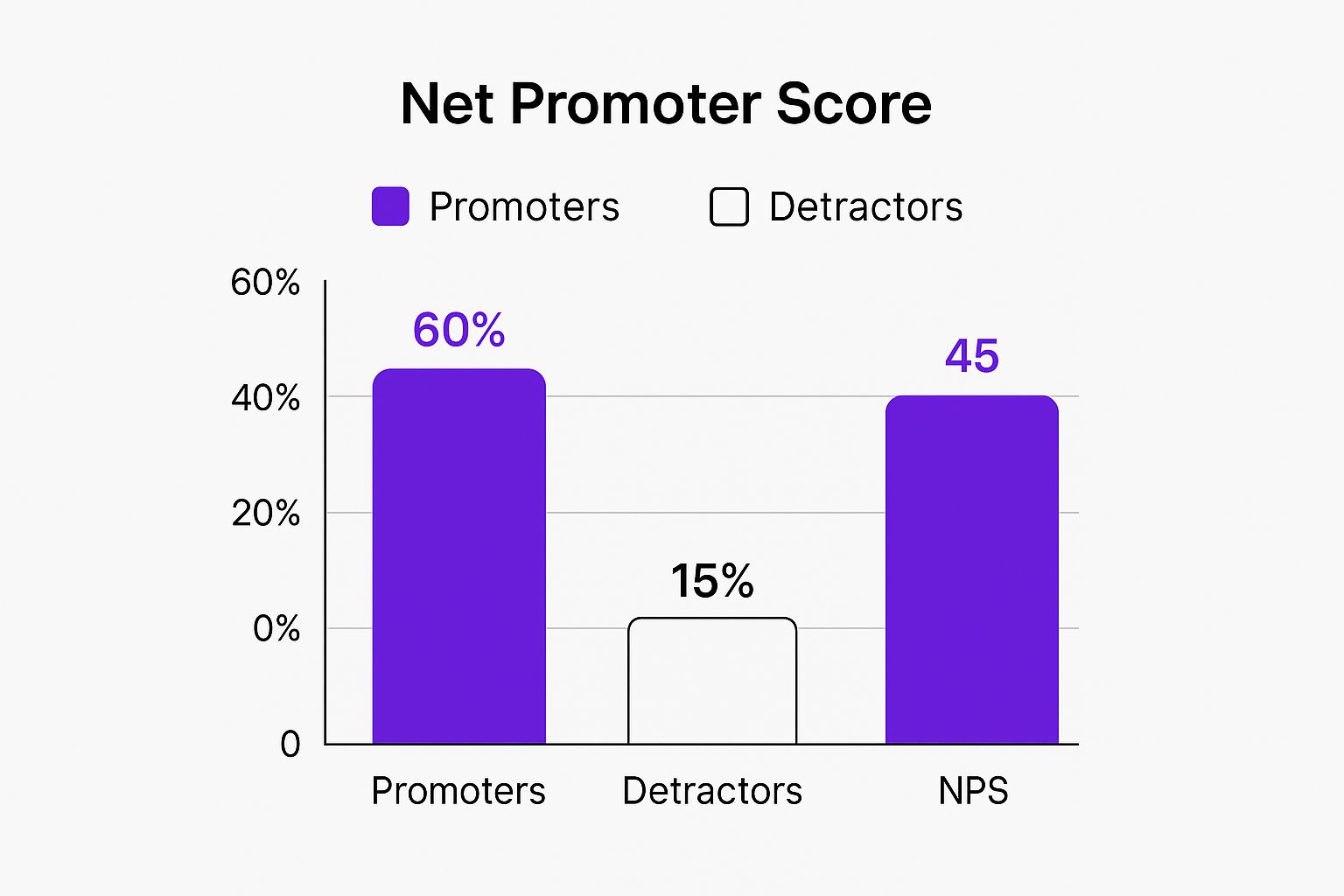

The final score is calculated by subtracting the percentage of Detractors from the percentage of Promoters. This results in a score ranging from -100 to +100, providing a clear snapshot of customer sentiment.

Calculating Your NPS

Imagine you survey 100 customers. If 60 are Promoters (60%) and 15 are Detractors (15%), your calculation is simple: 60% - 15% = 45. Your NPS is +45. The following bar chart visualizes this exact calculation, showing how Promoter and Detractor percentages combine to create the final score.

This visualization clearly demonstrates that your final NPS is a direct reflection of the balance between your happiest and unhappiest customers.

When and Why to Use NPS

NPS is highly effective for benchmarking your performance against competitors and tracking loyalty trends. For instance, tech giants like Apple consistently score above 70, while an industry leader like Southwest Airlines maintains a score over 50.

Use NPS at key journey milestones, such as post-purchase or after a support interaction, to gauge satisfaction at critical moments. The real power of NPS is unlocked when you follow up with an open-ended question like, "What is the primary reason for your score?" This qualitative feedback turns a simple number into actionable insights, helping you understand the "why" behind the score. By tracking these trends, you can focus on strategic improvements, such as converting Passives into Promoters, to steadily increase loyalty.

2. Customer Satisfaction Score (CSAT)

The Customer Satisfaction Score (CSAT) is a fundamental metric among the ways to measure customer satisfaction, designed to gauge a customer's happiness with a specific interaction, product, or service. It's a direct and immediate measure, typically asking a simple question like, "How satisfied were you with your recent purchase?" The response is usually captured on a 1-5 or 1-10 scale.

This method's strength lies in its transactional focus, providing a clear snapshot of performance at a single touchpoint. Unlike broader loyalty metrics, CSAT zeroes in on the immediate "in-the-moment" feeling a customer has. Its straightforward nature makes it easy for customers to respond and for businesses to collect and analyze feedback quickly.

The final score is calculated as the percentage of "satisfied" customers. On a 5-point scale, this typically includes anyone who responded with a 4 (Satisfied) or 5 (Very Satisfied).

Calculating Your CSAT Score

Imagine you survey 200 customers after they interact with your support team. If 150 of them give a rating of 4 or 5, your CSAT score is calculated by dividing the number of satisfied customers by the total number of responses and multiplying by 100. The calculation would be: (150 / 200) * 100 = 75%. Your CSAT score is 75. For a deeper dive into one of the most widely used metrics, refer to a step-by-step guide on how to calculate CSAT score to gauge satisfaction with specific touchpoints.

When and Why to Use CSAT

CSAT is best used to measure short-term happiness right after a specific interaction. It is highly effective for evaluating moments like a support ticket resolution, the completion of an online purchase, or after a customer uses a new feature. Companies like Uber use it to rate individual rides, while Amazon uses it for specific product and seller feedback.

To maximize its value, deploy CSAT surveys immediately after the key moment to capture fresh, accurate feedback. Pair the rating question with an open-ended follow-up like, "What could we have done to improve your experience?" This provides crucial context behind the score, turning a simple number into actionable data. By setting internal benchmarks and consistently tracking CSAT for different interactions, you can pinpoint operational weaknesses and celebrate areas of success.

3. Customer Effort Score (CES)

Customer Effort Score (CES) is a powerful metric that shifts the focus from delighting customers to making their interactions as seamless as possible. Popularized by Matthew Dixon and his team at CEB (now Gartner), CES measures how much effort a customer had to exert to get an issue resolved, a question answered, or a task completed. The core principle, backed by Harvard Business Review research, is that reducing customer effort is a more reliable driver of loyalty than exceeding expectations.

The survey typically asks a direct question like, "To what extent do you agree with the following statement: The company made it easy for me to handle my issue." Responses are usually collected on a 1-to-7 scale, from "Strongly Disagree" to "Strongly Agree."

- High Effort (1-3): These scores indicate significant friction in the customer journey. These customers are at high risk of churning and may share their negative experiences.

- Neutral (4-5): The experience was neither exceptionally difficult nor particularly easy. These interactions represent missed opportunities to build loyalty.

- Low Effort (6-7): The process was smooth and easy. These positive experiences strongly correlate with repeat business and increased customer lifetime value.

The final score is often calculated as the average of all responses. A higher average score signifies a lower-effort, more positive customer experience.

How to Apply CES

Imagine an e-commerce site wants to improve its return process. After a customer completes a return, an automated email sends a CES survey. If the average score is low, like 3.5, it signals the process is cumbersome. The company can then investigate specific friction points, such as a confusing returns portal or unclear instructions, and make targeted improvements.

This method reveals specific operational weaknesses that, when fixed, directly boost satisfaction.

When and Why to Use CES

CES is one of the most effective ways to measure customer satisfaction in transactional contexts. It is best used immediately after a specific interaction, such as a support ticket resolution, a software onboarding session, or a purchase checkout. Microsoft, for instance, uses CES to pinpoint and streamline difficult support interactions, while banks measure it to simplify the account opening process.

The real value of CES comes from its diagnostic power. By asking customers about the ease of a specific task, you get highly actionable feedback. Combine CES data with process analytics to identify high-effort touchpoints and train staff on effort reduction techniques. This focus on removing friction not only improves loyalty but also enhances operational efficiency.

4. Customer Surveys and Questionnaires

Customer surveys and questionnaires are foundational tools among the various ways to measure customer satisfaction, offering a structured method for gathering in-depth, multi-dimensional feedback. Unlike single-question metrics, comprehensive surveys allow you to explore various facets of the customer experience, from product quality and service interactions to brand perception and user preferences. They can be deployed as short, targeted pulse surveys or as extensive annual studies.

These tools gather data through a mix of question types, providing both quantitative and qualitative insights:

- Rating Scales (e.g., Likert scales): Customers rate their agreement or satisfaction with specific statements, such as "The checkout process was easy and intuitive."

- Multiple-Choice Questions: These offer predefined answers, making it easy to segment customer feedback based on specific choices or demographics.

- Open-Ended Questions: These invite customers to provide detailed, narrative feedback in their own words, revealing the "why" behind their ratings.

This combination of question formats allows you to collect specific, measurable data while also capturing the nuances of customer sentiment.

Designing Effective Surveys

Imagine an e-commerce retailer wants to understand post-purchase satisfaction. They could deploy a survey asking customers to rate their experience on a 1-5 scale for delivery speed, product quality, and packaging. It could then use skip logic: if a customer gives a low rating for delivery speed, a follow-up open-ended question asks, "What could we do to improve our shipping process?" This personalizes the survey flow and gathers highly specific, actionable feedback.

When and Why to Use Surveys

Surveys are exceptionally versatile and can be used at nearly any point in the customer journey. They are ideal for deep-dive analysis when you need to understand complex issues or gather comprehensive feedback that a single metric cannot provide. For instance, software companies often use them to collect detailed product feedback before a major update, while airlines use them to assess overall service quality from booking to baggage claim.

To maximize effectiveness, keep surveys concise and focused on a clear objective. Always test them with a small group before a full launch to identify confusing questions. Importantly, communicate to customers how their feedback will be used. This not only increases response rates but also shows that you value their input, reinforcing a positive customer relationship.

5. Customer Interviews and Focus Groups

While quantitative metrics provide the "what," customer interviews and focus groups deliver the crucial "why." These qualitative research methods are among the most effective ways to measure customer satisfaction by engaging directly with users to uncover deep, contextual insights. Customer interviews are one-on-one conversations, whereas focus groups bring together a small, moderated group of 6-12 participants to discuss their experiences, needs, and perceptions of your brand.

This direct interaction allows you to explore nuances that surveys can't capture. You can observe body language, hear the tone of voice, and ask follow-up questions in real-time. This rich, anecdotal data provides a human dimension to your satisfaction metrics.

- Customer Interviews: Best for exploring individual user journeys, sensitive topics, and detailed experiences.

- Focus Groups: Ideal for brainstorming, gauging group consensus, and understanding shared social norms or attitudes toward a product or service.

Leading companies use these methods to inform major decisions. For example, Airbnb conducts extensive user experience research sessions to understand how hosts and guests interact with their platform, while major automotive brands use focus groups to refine vehicle design and in-car technology based on direct feedback.

How to Conduct Effective Sessions

The success of these qualitative methods hinges on careful planning and execution. The goal is to create a comfortable environment where participants feel they can speak openly and honestly. A skilled, unbiased moderator is essential to guide the conversation without leading it, ensuring the feedback is authentic.

Recruiting the right participants is also critical. Aim for a diverse group that represents your key customer segments. During the session, record it (with explicit permission) so you can focus on the conversation and perform a thorough customer feedback analysis later. Prepare a guide with open-ended questions, but remain flexible enough to explore unexpected topics that arise naturally.

When and Why to Use This Method

Use customer interviews and focus groups when you need to understand complex behaviors or motivations that numbers alone cannot explain. They are invaluable during the early stages of product development, before a major service overhaul, or when investigating a sudden drop in other satisfaction metrics like NPS or CSAT.

While more resource-intensive than automated surveys, the return on investment is immense. These conversations can reveal unmet needs, significant pain points, and innovative ideas directly from your customers' mouths. For instance, a bank might use interviews to discover why customers are abandoning a new mobile banking feature. By pairing these qualitative findings with quantitative survey data, you can validate your insights at scale and make strategic improvements with confidence, ensuring your decisions are truly customer-centric.

6. Social Media Monitoring and Sentiment Analysis

Social Media Monitoring is a powerful, modern way to measure customer satisfaction by tapping into the candid, unprompted conversations happening online. Instead of asking customers for feedback, this method involves tracking mentions, reviews, and comments across social media platforms, forums, and review sites. By using specialized tools and human analysis, you can capture a real-time pulse of public opinion regarding your brand, products, or services.

Sentiment analysis then categorizes this collected data into three key buckets:

- Positive: Posts expressing praise, satisfaction, or delight with your brand. These often highlight your strengths and can be leveraged for marketing.

- Neutral: Mentions that are informational or lack strong emotion. These might be questions or factual statements about your company.

- Negative: Comments from unhappy customers detailing complaints, frustrations, or poor experiences. These are critical for identifying and addressing pain points.

This approach provides an unfiltered view of the customer experience, revealing insights that traditional surveys might miss because the feedback is offered spontaneously.

Tracking and Analyzing Public Sentiment

Implementing this method involves setting up monitoring for keywords related to your brand, products, and even competitors. For example, a retail brand might monitor Instagram for tagged photos and comments about a new clothing line, while an airline like Southwest actively tracks Twitter for real-time service issues and customer feedback. Beyond general mentions, you can also leverage specialized tools to extract tweets from platforms like X (formerly Twitter) for a deeper dive into public sentiment.

The goal is to go beyond just counting mentions and truly understand the emotion behind them. This is one of the most proactive ways to measure customer satisfaction and protect your brand's reputation.

When and Why to Use Social Media Monitoring

Social media monitoring is essential for any brand with a digital presence. It’s particularly effective for B2C companies where public perception can directly impact sales. Use it continuously to get a baseline sentiment and set up alerts for sudden spikes in negative comments, which could signal a widespread product or service issue.

The key benefit is speed. You can identify and respond to a customer complaint on Twitter within minutes, potentially turning a negative experience into a positive one. By tracking sentiment trends over time, you can correlate changes with marketing campaigns, product launches, or policy updates to understand their impact. Learn more about how to measure social media success and turn these insights into strategic advantages.

7. Website Analytics and User Behavior Tracking

Website analytics and user behavior tracking offer a powerful, indirect method for measuring customer satisfaction. Instead of asking customers how they feel, this approach observes what they do. By analyzing digital footprints like navigation paths, click-through rates, and time spent on specific pages, you can infer satisfaction levels from the quality of their user experience. This objective data provides a real-time pulse on how easily and effectively users are achieving their goals on your site.

These digital behaviors often serve as direct proxies for satisfaction or frustration:

- High Bounce Rates: A high percentage of users leaving after viewing only one page can signal a mismatch between their expectations and your content, a sign of dissatisfaction.

- Low Time on Page: If users spend very little time on critical pages, it may indicate that the information is unhelpful, confusing, or not engaging.

- High Cart Abandonment: In e-commerce, users who add items to their cart but don’t complete the purchase are often hitting a friction point, like unexpected shipping costs or a complicated checkout process.

- Healthy Conversion Rates: Conversely, when users successfully complete desired actions (e.g., signing up for a newsletter, completing a purchase), it indicates a smooth and satisfying journey.

This data-driven approach moves beyond subjective feedback to uncover hidden pain points and opportunities in the user experience.

Leveraging Behavioral Insights

Imagine you run a SaaS business and notice a significant drop-off in user engagement with a key feature. By using tools like heatmaps, you might discover that the button to access this feature is poorly placed or its label is unclear. This insight, derived purely from behavioral data, points to a clear area for improvement that directly impacts user satisfaction. Similarly, an e-commerce store can analyze user session recordings to see exactly where customers struggle during checkout, allowing them to streamline the process and reduce frustration.

When and Why to Use Behavior Tracking

This method is essential for any business with a digital presence, as it provides continuous, passive feedback without causing survey fatigue. It's particularly effective for identifying technical issues or UX flaws that customers may not be able to articulate clearly in a traditional survey. For example, a customer might just say "your website is confusing," but analytics can pinpoint the exact page or form field that is causing the problem.

For maximum impact, combine this quantitative data with qualitative feedback. A high bounce rate tells you what is happening, while a follow-up survey or review can tell you why. For instance, after observing user behavior, you can prompt satisfied customers who complete a purchase to leave a review, which you can then showcase. Showcasing positive experiences on a well-designed testimonial page can further build trust with new visitors. Learn more about how to create an effective website testimonial page to leverage this social proof. By blending analytics with direct feedback, you create a comprehensive view of the customer experience.

7 Methods to Measure Customer Satisfaction Compared

| Method | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Net Promoter Score (NPS) | Low: Single question, simple calculation | Low: Minimal survey resources needed | Measures customer loyalty and likelihood to recommend | Benchmarking customer loyalty, tracking trends over time | Easy to implement, high response rates, industry benchmarks |

| Customer Satisfaction Score (CSAT) | Low to Medium: Flexible question formats | Low: Simple surveys, customizable | Direct satisfaction measurement at touchpoints | Measuring immediate satisfaction after interactions | Direct feedback, customizable, high response rates |

| Customer Effort Score (CES) | Medium: Needs task-specific questions | Medium: Survey design + analysis | Predicts loyalty by measuring effort required | Identifying friction points and improving processes | Strong predictor of retention, actionable insights |

| Customer Surveys and Questionnaires | High: Complex design, multiple questions | High: Time for design, distribution, and analysis | Detailed insights across multiple satisfaction aspects | Comprehensive feedback across customer journey | Deep insights, root cause analysis, segmentation |

| Customer Interviews & Focus Groups | High: Time-intensive, requires skilled facilitators | High: Staffing and scheduling | Rich qualitative insights, uncover emotional drivers | Exploratory research, understanding complex issues | In-depth feedback, uncovers hidden factors |

| Social Media Monitoring & Sentiment Analysis | Medium: Requires tools and analysis expertise | Medium: Software tools + human review | Real-time sentiment and brand health monitoring | Tracking unprompted feedback and trending issues | Continuous insights, authentic opinions, cost-effective |

| Website Analytics & User Behavior Tracking | Medium to High: Technical implementation and analysis | Medium to High: Tools and expertise | Objective behavior data, identifying UX issues | Digital touchpoint optimization, user journey mapping | Unbiased data, large samples, direct business correlation |

Turning Measurement into Momentum

The journey to understanding your audience doesn't end once a survey is completed or a metric is logged. The true power of the methods we've explored, from the direct simplicity of CSAT to the nuanced stories uncovered in customer interviews, lies not in the measurement itself, but in the momentum it creates. These aren't just tools for generating reports; they are catalysts for meaningful change and foundational pillars for sustainable growth. Mastering these diverse ways to measure customer satisfaction is about building a continuous, dynamic conversation with the people who matter most to your business.

The most successful brands don't just pick one method and stick with it. Instead, they create a comprehensive listening architecture. They use quantitative metrics like Net Promoter Score and Customer Effort Score to quickly identify trends and flag potential friction points. Simultaneously, they leverage qualitative feedback from social media sentiment analysis and in-depth interviews to understand the human stories, emotions, and motivations behind those numbers. This blended approach is where insight transforms into action.

From Data Points to Strategic Direction

Think of each piece of feedback as a single dot on a much larger canvas. A low CES score is one dot. A glowing review on social media is another. An abandoned cart tracked via website analytics is a third. Individually, they offer a glimpse. Together, they paint a complete, actionable picture of your customer journey.

Your goal is to connect these dots. By integrating these different data streams, you can move from a reactive state of fixing isolated problems to a proactive one of designing exceptional experiences. You begin to anticipate needs, personalize interactions, and build a brand that customers don't just buy from, but actively champion.

Closing the Feedback Loop for Exponential Growth

Ultimately, the most critical step is closing the feedback loop. This means not only acting on the insights you gather but also showing your customers that you are listening. When you implement a suggestion from a survey or fix a pain point identified in a customer interview, you validate their effort and strengthen their loyalty. This cycle of listening, acting, and acknowledging is the engine of a customer-centric culture.

This is where the process becomes a powerful growth driver. Positive feedback, when identified and captured, is more than just a vanity metric. It's your most authentic marketing asset. By systematically collecting and amplifying the voices of your satisfied customers through testimonials and reviews, you turn positive sentiment into compelling social proof. This not only attracts new customers but also reinforces the value you provide to your existing ones, transforming passive satisfaction into active, vocal advocacy. Your efforts to measure satisfaction thus become a self-perpetuating engine for building trust, enhancing reputation, and driving revenue.

Ready to turn your customer satisfaction insights into your most powerful marketing assets? EndorseFlow makes it effortless to collect, manage, and showcase stunning video testimonials and reviews from your happiest customers. Stop letting positive feedback fade away and start building a library of authentic social proof that drives growth.

Discover how EndorseFlow can amplify your brand's voice today.