Strategies for Increasing Customer Lifetime Value

Discover proven strategies for increasing customer lifetime value. Learn how to boost loyalty, retention, and long-term revenue with actionable insights.

Posted by

When you get right down to it, increasing customer lifetime value (CLV) is about playing the long game. It’s a fundamental shift away from the constant, costly chase for new leads and toward nurturing the customers you’ve already won.

Think of it this way: you're turning one-time buyers into predictable revenue streams and, eventually, your most passionate brand advocates.

Why Customer Lifetime Value Is Your Growth Compass

In a world where getting a new customer through the door costs more every year, focusing on your existing base isn’t just smart—it’s a survival strategy. CLV is more than just another metric on your dashboard. It’s a philosophy. It’s the compass that should guide every decision you make, from marketing and product development to customer service.

When you start using CLV as your true north, you evaluate every single action by one simple question: "Does this build a stronger, more profitable long-term relationship with our customers?"

This mindset has a direct and powerful impact on your bottom line. I've seen it time and time again. The key is balancing your CLV with your Customer Acquisition Cost (CAC). A healthy business usually needs a 3:1 ratio of CLV to CAC. That's the benchmark. But with acquisition costs jumping by as much as 222% in the last eight years, the pressure is on to get more value from every customer you have. You can dig deeper into these trends and their impact to see just how critical this has become.

The Core Levers of CLV

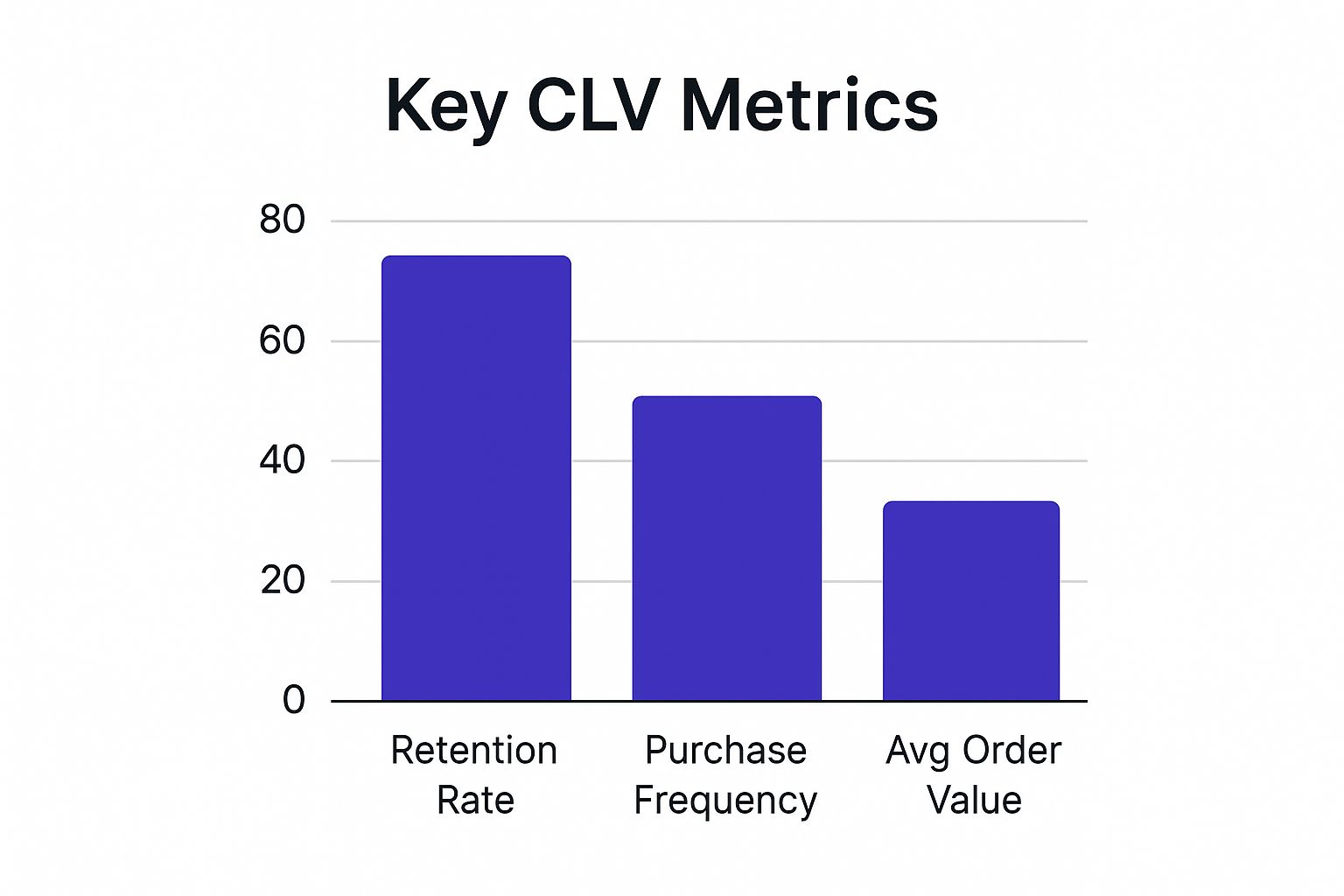

So, how do you actually improve CLV? It really boils down to moving the needle on three key behaviors. If you focus your energy here, you’ll see a compounding effect that dramatically boosts what each customer is worth to you over time.

- Boost Retention Rate: This is all about keeping customers around. Even a tiny bump in retention can explode your profitability down the line.

- Increase Purchase Frequency: You want to give customers good reasons to buy from you more often. Think timely offers, subscriptions, and genuinely useful communication—not just spam.

- Raise Average Order Value (AOV): Encourage customers to spend a little more with each purchase. This is where smart upselling, cross-selling, and product bundles come into play.

This graphic really breaks down how these three pillars work together to drive up your CLV.

As you can see, improving any one of these—retention, purchase frequency, or order value—directly feeds into a healthier, higher CLV.

A business built around CLV is a business built for the long haul. It prioritizes sustainable growth over the short-term sugar rush of new acquisitions, creating brand resilience and a loyal customer base that delivers consistent revenue.

Contrast that with a model that’s always chasing new leads. Of course, acquisition is important. But when you rely on it too heavily, you end up with a transactional, unstable business where you’re constantly trying to refill a leaky bucket.

To make this crystal clear, I've put together a table comparing the two approaches. It shows exactly why a CLV-focused strategy is the key to building a more stable and profitable business.

CLV-Focused vs. Acquisition-Focused Business Models

| Metric | CLV-Focused Strategy | Acquisition-Focused Strategy |

|---|---|---|

| Primary Goal | Maximize long-term customer relationships and profitability. | Maximize the number of new customers acquired. |

| Marketing Spend | Balanced between retention and acquisition efforts. | Heavily weighted toward top-of-funnel acquisition. |

| Revenue Stability | Predictable, recurring revenue from a loyal base. | Volatile, dependent on a constant influx of new buyers. |

| Customer Relationships | Deep, relationship-based, and built on trust. | Transactional, often ending after the first purchase. |

| Brand Loyalty | High, with customers acting as advocates. | Low, with customers easily swayed by competitors. |

| Profit Margins | Higher over time due to lower retention costs. | Lower, eroded by high and rising acquisition costs. |

Ultimately, the numbers don't lie. A business that obsesses over its customers will always outperform one that only obsesses over its leads.

Calculating and Understanding Your CLV Baseline

Before you can start boosting your customer lifetime value, you need a starting point. It’s a simple truth: you can’t improve what you don’t measure. Establishing your CLV baseline gives you a concrete number to work from and, more importantly, a benchmark to see if your new strategies are actually working.

Before you can start boosting your customer lifetime value, you need a starting point. It’s a simple truth: you can’t improve what you don’t measure. Establishing your CLV baseline gives you a concrete number to work from and, more importantly, a benchmark to see if your new strategies are actually working.

But don’t worry, calculating CLV doesn't have to be some intimidating, data-scientist-level task. You can get started with a simple, historical model that gives you actionable insights right away. This approach just looks at past customer behavior to paint a clear picture of what a customer has been worth to your business so far.

The best part? The formula is straightforward and uses data you probably already have sitting in your sales or e-commerce platform.

A Simple Formula for Historical CLV

Let's break down the most common way to calculate historical CLV. It all comes down to three core metrics that, when combined, tell a powerful story about your customer relationships and their financial impact.

- Average Purchase Value (APV): This is just the average amount a customer spends in a single transaction. You can find it by dividing your total revenue over a set period by the number of orders in that same timeframe.

- Purchase Frequency (PF): This metric tells you how often the average customer comes back to buy from you. To get this number, divide the total number of orders by the number of unique customers over that period.

- Average Customer Lifespan: This is the average amount of time a customer actively buys from you. Pinpointing this can be a bit tricky, but a great starting point is to find the average time between a customer's very first and very last purchase.

Got those three numbers? Great. The math from here is simple.

CLV = (Average Purchase Value x Purchase Frequency) x Average Customer Lifespan

This formula gives you a tangible baseline. It's the first real step toward understanding which levers you can pull—like getting people to buy more often or sticking around longer—to grow your revenue without constantly chasing brand-new leads.

Putting Your CLV Number into Context

Knowing your CLV is one thing. Understanding what it means for your business is where the magic happens.

For instance, the average CLV in e-commerce often hovers between $100 and $300, but this figure can swing wildly depending on your industry and what you sell. A brand selling high-ticket furniture will naturally have a higher CLV than one selling everyday socks. You can explore more e-commerce benchmarks to see how you stack up.

The real power of CLV emerges when you stop looking at a single, company-wide average and start segmenting your customers. Trust me, not all customers are created equal, and your CLV data will prove it.

Segmentation is how you identify your most valuable customer groups and get smart about how you treat them. Think about these real-world scenarios:

- An E-commerce Store: Imagine you segment CLV by the first product a customer ever bought. You might discover that customers who start with "Product A" have a 3x higher CLV than those who start with "Product B." That insight is gold. It tells you to feature Product A way more prominently in your welcome emails and acquisition ads.

- A SaaS Company: A software business could segment users by their subscription plan. If "Pro Plan" users have a massively higher CLV and a lower churn rate than "Basic Plan" users, it validates pouring more resources into features and support for that top tier. It also shines a spotlight on the opportunity to create better upgrade paths for your Basic users.

By breaking down your CLV, you can clearly see your high-value cohorts, your average spenders, and the customers who are at risk of leaving. This turns a simple metric into a strategic tool, guiding every decision you make—from where to spend your marketing budget to which products to develop next—for the biggest possible return.

Using AI for Hyper-Personalized Customer Experiences

Let's be honest: the days of one-size-fits-all marketing are over. If you want to boost customer lifetime value, you have to make each customer feel like you're speaking directly to them. This is where AI stops being a tech buzzword and becomes a real, revenue-generating part of your strategy.

AI digs into your customer data—everything from past purchases to browsing habits—to figure out what your customers actually want, often before they do. Think about how Netflix keeps you glued to the screen. Its recommendation engine doesn't just throw random shows at you; it builds a list so perfectly curated it feels like a friend made it. That's the kind of personal touch that builds loyalty and keeps people coming back.

You can do the same thing. With a tool like EndorseFlow’s AI Content Generator, you can scale that personal touch. It helps you draft personalized emails, social media content, and product recommendations that speak to specific customer groups, turning raw data into conversations that actually convert.

Harnessing Predictive Analytics

True personalization isn't just about looking backward at what a customer bought. It's about predicting what they'll do next. Predictive analytics is the engine for this, using AI to comb through your data for patterns that signal future behavior.

This lets you get ahead of the game. For instance, if your data shows that customers who buy your signature coffee maker tend to purchase espresso pods about three weeks later, you can schedule a targeted email with a special offer on pods to land in their inbox right on cue. It's an easy sale, sure, but more importantly, it shows your brand is paying attention.

When you proactively meet customer needs before they even have to ask, you transform your brand from just another vendor into a trusted partner. This shift is what truly drives customer lifetime value.

It's also a powerful tool for spotting at-risk customers. AI can flag users whose engagement has dipped, giving you a chance to step in with a "we miss you" offer or a special incentive to win them back before they're gone for good.

Segmenting for Maximum Impact

AI-driven personalization only works if you’re smart about segmentation. Not all customers are the same, so your outreach shouldn't be either. The foundation of this whole approach is mastering market segmentation, which is all about grouping customers by shared traits so you can tailor your message. For any business looking to get serious about this, mastering market segmentation is a non-negotiable first step.

Here are a few practical segments to get you started:

- High-Value Customers: These are your VIPs. Use AI to offer them exclusive early access to new drops, send personalized thank-you notes, or create loyalty rewards that truly feel special.

- Recent First-Time Buyers: This group is critical and needs some hand-holding. AI can trigger an automated welcome series that introduces your brand story, offers tutorials for their new product, and suggests complementary items to enhance their experience.

- Cart Abandoners: AI can send personalized follow-up emails that do more than just remind them what they left behind. You can include testimonials related to those exact products—a perfect example of using social proof marketing to give them that final nudge.

There's no question that the future of CLV growth is tied to AI. By 2025, the game will have completely changed. Projections show that 61% of consumers will expect hyper-personalized experiences, including custom recommendations and marketing. This is part of a bigger trend where 89% of businesses will compete almost entirely on the customer experience they provide. Giants like Netflix are already proving it, generating over $1 billion annually from their AI recommendation engine alone.

The chart below shows just how different AI technologies are expected to boost CLV.

As you can see, predictive analytics and personalized recommendations are leading the pack. The good news? These AI-powered strategies aren't just for massive corporations anymore. They are accessible and essential for any business focused on building real, sustainable growth.

How Social Proof Keeps Customers Coming Back for More

While a personalized touch might win you the first sale, it’s trust that makes customers stick around for the long haul. This is where social proof becomes your secret weapon for boosting customer lifetime value. It’s that constant, quiet reassurance whispering, "You made the right choice."

Put yourself in your customer’s shoes. When they see other real people—people just like them—getting great results with your product, it validates their own decision to buy from you. It’s a powerful feeling. This shared experience turns a simple transaction into something more, laying the groundwork for a lasting relationship.

The goal here is simple: turn your happiest customers into your most powerful marketing channel. Their genuine stories build a level of trust that no slick ad campaign can ever hope to match.

Build a Social Proof Machine, Not a One-Off Campaign

Authenticity is what gives social proof its punch, but you can't just leave the collection process to chance. To really make this work, you need a system—a reliable way to bring in a steady flow of genuine customer stories.

An "ask whenever you remember" approach is a recipe for an empty testimonial folder. What you need is a playbook that makes giving feedback a natural, easy, and even enjoyable part of the customer experience. This is where the right tools change the game completely.

For instance, a platform like EndorseFlow’s Testimonial Automation takes all the friction and guesswork out of the equation. You can set up automated requests that go out at just the right moment, like after a customer makes their second purchase or leaves a glowing satisfaction rating. The timing is everything; you’re catching them right when their positive feelings are at their peak.

By making it ridiculously easy for customers to share their wins, you’re not just collecting reviews. You’re inviting them to become part of your brand's story. That sense of participation makes them feel more connected and valued.

You want to move from passively hoping for reviews to proactively building a library of user-generated content (UGC). This should include a mix of both text and video testimonials—videos are especially good at conveying real emotion and building a human connection.

Turn That Feedback into Marketing Fuel

So, you’ve gathered this goldmine of customer feedback. Now what? This is the step where so many businesses stumble. A brilliant testimonial buried on a hard drive isn't doing anything for your CLV.

Your job is to get those voices out there. Amplify them across every channel your customers hang out on. This creates a powerful surround-sound effect of positive reinforcement. Using a Social Scheduler, you can strategically sprinkle these authentic stories into your content calendar.

Think about how this plays out in the real world:

- For a SaaS company: A user sends a video testimonial raving about how one of your features saved their team hours. You schedule that video to post on LinkedIn, tag the customer’s company (with their blessing, of course), and explain how that feature solves a huge industry pain point.

- For an e-commerce brand: A customer leaves a fantastic review about the quality of your products. You can transform that quote into a sharp-looking graphic and schedule it for Instagram, timing it perfectly with a sale on related items.

This isn’t just about posting content—it’s about creating a positive feedback loop. When your current customers see their peers being celebrated on your social feeds, it reinforces their own loyalty. For anyone on the fence about another purchase, it’s often the final nudge they need.

If you want a deeper dive, learning how to get customer testimonials that actually convert is an excellent next step.

When you consistently showcase your happy customers, you stop selling just a product. You start selling confidence and community. That powerful combo is the bedrock of any smart strategy for increasing customer lifetime value, turning satisfied buyers into loyal advocates who are in it for the long run.

Designing Loyalty Programs That Actually Work

A great loyalty program does more than just hand out points. It builds a real connection that keeps customers invested in your brand. If you want to actually move the needle on customer lifetime value, your program needs to feel less like a transaction and more like a relationship.

Forget the generic, one-size-fits-all templates. The best programs create memorable experiences that turn one-time buyers into genuine fans. The goal is to make them feel seen, appreciated, and part of an exclusive club. When you get this right, you’re not just stopping customers from leaving—you're creating a powerful reason for them to come back again and again.

Moving Beyond Basic Points

Simple point systems have their place, but today's customers expect more. They're tired of the old "buy ten, get one free" model. They want experiences, exclusivity, and a feeling of belonging. The real magic happens when you mix tangible rewards with those intangible perks that make people feel special.

Consider a tiered system, for instance. As customers spend more, they unlock new status levels with better benefits. This gamifies the whole experience, giving them a ladder to climb and a reason to stick with you. It’s a proven model for fostering long-term commitment.

Another killer strategy is the "surprise and delight" approach. Instead of predictable rewards, you randomly gift a loyal customer a free product, an unexpected upgrade, or even just a handwritten thank-you note. These unprompted moments of generosity create powerful, positive memories that people can't wait to share.

A loyalty program's true power is its ability to make customers feel seen. When they trust your program to reward them in a meaningful way, they’re far more likely to stick around, even if a competitor offers a slightly lower price.

Choosing the Right Loyalty Model for Your Business

The best loyalty program is one that fits your business model and what your customers actually want. There’s no single right answer, so figuring out your options is the first step toward building something that works.

To help you sort through the noise, here's a quick look at some popular loyalty program models, what they do best, and where they fit.

Choosing the Right Loyalty Program Model

| Program Type | Key Benefit | Best For |

|---|---|---|

| Tiered Program | Encourages higher spending to unlock "status" and better perks, fostering long-term loyalty. | Brands with a wide range of customer spending, like airlines, cosmetics, or high-frequency e-commerce. |

| Paid (VIP) Program | Creates a reliable, recurring revenue stream and offers immediate, high-value perks to members. | Businesses that can offer significant value upfront, like free shipping, exclusive content, or deep discounts. |

| Value-Based Program | Connects with customers on an emotional level by aligning with their values, such as charitable donations. | Mission-driven brands with a strong community focus, like sustainable apparel or ethical food companies. |

| Surprise & Delight | Builds powerful emotional connections and generates organic word-of-mouth marketing through unexpected rewards. | Any business looking to create memorable, shareable customer experiences without a complex points structure. |

Looking at this table, you can start to see how the structure of your program should directly support your business goals—whether that's encouraging bigger orders, building a community, or just creating buzz.

Launching and Communicating Your Program

Once you've picked a model and designed your program, its success comes down to one thing: communication. If customers don't know it exists or can't figure out how it works, it’s dead on arrival. Your launch plan is just as critical as the rewards themselves.

Start by building a dedicated landing page that clearly explains the benefits and rules. Use simple, exciting language to get people hyped. From there, promote it everywhere you can think of.

- Email Campaigns: Announce the program to your entire list and set up an automated onboarding series for new members.

- Social Media: Use your channels to highlight the best perks, showcase members who have redeemed rewards, and build a sense of exclusivity.

- In-Store or On-Site Signage: Make it impossible to miss. Use pop-ups on your website, banners in your store, and even inserts in your packaging to drive sign-ups.

Ultimately, a well-designed loyalty program is an engine for growth. By mixing valuable rewards, exclusive perks, and crystal-clear communication, you can build a system that doesn't just drive repeat purchases—it creates an army of devoted brand advocates.

Measuring and Optimizing Your CLV Strategy

So, you’ve put together a strategy to boost customer lifetime value. That’s a great first step, but the real work starts now. A CLV strategy isn't static—it's a living, breathing part of your business that needs constant attention.

You can't just launch a loyalty program, send a few emails, and hope for the best. You have to get in the trenches, measure what’s working (and what isn’t), and be ready to adapt. It's an ongoing cycle of measuring, analyzing, and tweaking.

Think of it like tuning an engine. You don't just turn the key and drive off; you listen for strange noises and make adjustments. The numbers are those noises, telling you exactly where to focus your efforts. Flying blind is a surefire way to waste time and money.

Key Performance Indicators to Watch

To really get a feel for how your strategy is performing, you need to look beyond the final CLV number. You need a dashboard of metrics that tell the complete story of your customer relationships.

Each of these KPIs gives you a different piece of the puzzle:

- Repeat Purchase Rate: This one’s simple but incredibly telling. Are customers coming back for more? If this number is climbing, you know your retention efforts are paying off. It's a direct signal of loyalty.

- Customer Churn Rate: This is your early warning system. It measures the percentage of customers who walk away. A high churn rate is a massive red flag, pointing to a crack in your customer experience that needs immediate fixing.

- Customer Satisfaction (CSAT) Scores: Straight up—are your customers happy? CSAT surveys are the most direct way to find out. They give you a real-time pulse on customer sentiment, helping you catch problems before they turn into churn.

The secret to optimization isn't some complex formula. It's about consistently looking at your data, asking for direct feedback, and having the courage to adjust your tactics. This feedback loop is what separates businesses with stagnant CLV from those that see it grow year after year.

Connecting Actions to Outcomes

Once you’re tracking these numbers, the real magic happens when you can connect them directly to your marketing actions. This is where you move from hoping your strategy works to knowing it does.

This is exactly where a tool with clear ROI tracking, like EndorseFlow, becomes invaluable. You can finally stop guessing and start measuring how your social proof campaigns—built on real, authentic testimonials—are actually impacting your bottom line.

For instance, you might discover that customers who watch a video testimonial have a 15% higher repeat purchase rate. That’s not just an interesting stat; it’s a powerful insight that tells you exactly where to double down. It’s also the perfect moment to explore how marketing automation for small business can help you scale up these winning tactics without adding more work to your plate.

A/B testing is another simple but powerful way to do this. You can test anything and everything. Pit two different email offers against each other. Compare different perks in your loyalty program. See which type of testimonial—a written review or a video—gets more engagement from a specific audience.

You could run a test offering "10% off your next purchase" versus a "free gift with your next purchase." By tracking the results, you might find that the free gift drives significantly more repeat business from your highest-value customers. That’s actionable intelligence.

Embracing this iterative approach—measure, analyze, and refine—is the final and most critical piece of the puzzle. It transforms your CLV strategy from a one-off project into a dynamic system that continuously adapts to build stronger, more profitable long-term customer relationships.

Got questions about Customer Lifetime Value? You're not alone. It's a metric that gets tossed around a lot, but figuring out how to actually move the needle can feel overwhelming.

Let's break down some of the most common questions we hear from founders and marketers just like you.

What’s the Quickest Way to Get a Bump in CLV?

Honestly, the fastest win comes from a simple, two-part play: step up your customer service and make your offers impossible to misunderstand.

Think about it. When a customer has an issue and you solve it quickly and with a human touch, you don't just fix a problem—you create a fan. That moment of frustration turns into a story they'll tell about how you went the extra mile. That's how you earn their next purchase.

Combine that with simple, high-value offers. Forget complicated discount codes or confusing loyalty tiers. A straightforward "free gift with your next purchase" or a clean "15% off for coming back" is direct, easy to act on, and immediately encourages that next sale. No big system overhaul needed, just an instant, tangible boost to your CLV.

How Does Customer Feedback Actually Affect CLV?

Customer feedback isn't just a suggestion box—it’s a literal roadmap to a higher CLV. When you actually listen to what your customers are saying, you get a direct look into what they want, what frustrates them, and what would make them stick around forever.

Acting on that feedback sends a powerful message: you see your customers as partners, not just as sales figures. That's how you build deep, emotional loyalty, which is the real engine behind repeat business and higher spending over time.

Ignoring feedback is a surefire way to lose customers. Embracing it is how you keep them invested in your brand's story for the long haul.

Can a Small Business Really Use These CLV Strategies?

Absolutely. In fact, small businesses have a secret weapon here: the personal touch. You can do things that big, faceless corporations simply can't. You don't need a massive budget to make a real impact.

Start with strategies that scale easily:

- Personalized Emails: Go beyond just using their first name. Mention a past purchase and ask how they're enjoying it. It feels like a real conversation, not a marketing blast.

- Build a Community: A simple Facebook group or an active, engaging Instagram presence makes customers feel like they're part of an exclusive club.

- Remember the Little Things: You’d be amazed at the loyalty a handwritten thank-you note or a quick, personal check-in email can generate. It’s the kind of thing money just can’t buy.

These are low-cost, high-impact moves that are perfect for smaller, agile teams.

Ready to turn that customer feedback into your most powerful marketing asset? EndorseFlow makes it effortless to collect authentic video and text testimonials and use AI to transform them into engaging social content. Start your 14-day free trial and see how building trust directly increases customer lifetime value.